The psychology of money explores how emotions, beliefs, and experiences shape financial decisions, revealing that success with money is deeply personal and often irrational.

Understanding the Interplay Between Money and Human Behavior

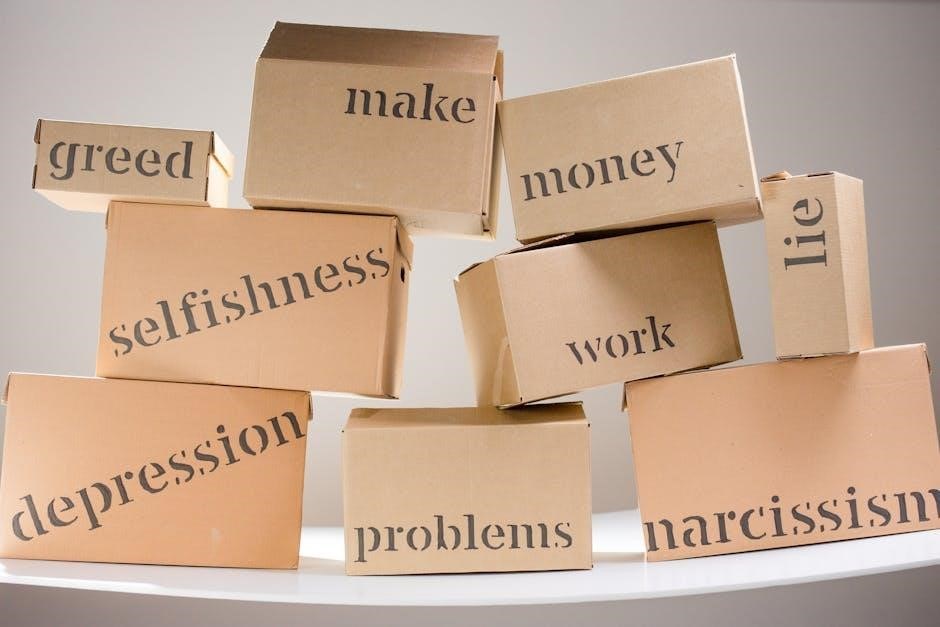

The psychology of money reveals how emotions, beliefs, and experiences shape financial decisions. Money is often viewed as a tool for security and freedom, but its impact extends beyond practicality. Cultural norms, personal values, and emotional triggers like fear and greed influence spending and saving habits. Cognitive biases, such as mental accounting, distort rational decision-making. Understanding this interplay is crucial for making better financial choices and fostering a healthier relationship with money. By recognizing these dynamics, individuals can align their financial behaviors with their long-term goals and values.

Why Financial Decisions Are Deeply Personal

Financial decisions reflect individual values, experiences, and emotions, making them inherently personal. Factors like upbringing, cultural background, and life events shape perceptions of money. Fear of loss or desire for security often outweigh logical analysis. Personal goals, such as freedom or legacy, influence spending and saving habits. Emotional biases, like loss aversion, further complicate decision-making. Understanding these personal elements is key to improving financial strategies and fostering better money management. Each person’s financial journey is unique, emphasizing the need for tailored approaches to achieve long-term success and satisfaction.

Key Concepts in the Psychology of Money

The psychology of money revolves around concepts like luck vs. skill, risk perception, and mental accounting, which shape how people make financial decisions and manage wealth.

Luck vs. Skill: The Role of Chance in Financial Success

Financial success often involves a mix of skill and luck, yet people tend to overemphasize skill and underplay chance. This mindset can lead to overconfidence in decisions, as individuals attribute successes to their abilities while dismissing the role of randomness. Conversely, failures are often blamed on bad luck rather than poor judgment. Recognizing the influence of chance helps in making more humble and realistic financial decisions, acknowledging that not every outcome is within one’s control. This balance is crucial for sustainable long-term financial strategies.

Risk vs. Uncertainty: How People Perceive Financial Risks

Risk and uncertainty are often conflated in financial decision-making, but they differ fundamentally. Risk involves known probabilities, while uncertainty entails unknown outcomes. People tend to be more comfortable with risk, as it allows for probabilistic assessments, whereas uncertainty creates anxiety due to the lack of clear parameters. This distinction significantly influences investment behaviors, with many preferring predictable risks over uncertain scenarios. Understanding this dichotomy helps individuals better navigate financial markets, where both elements are ever-present. Recognizing these nuances can lead to more informed and emotionally stable decision-making processes.

Mental Accounting: The Cognitive Biases in Money Management

Mental accounting refers to the cognitive bias where individuals treat money differently based on its source, purpose, or timing, despite its fungible nature. For instance, people often spend tax refunds more freely than hard-earned cash, perceiving the former as “extra money.” This irrational behavior leads to suboptimal financial decisions, such as overspending or undervaluing savings. Mental accounting highlights how emotions and context, rather than logic, dictate money management. Recognizing these biases is crucial for aligning financial behaviors with long-term goals, fostering healthier relationships with wealth and resource allocation.

Human Behavior and Money

Human behavior and money are deeply intertwined, influenced by emotions like fear and greed, habits, and cognitive biases that often lead to irrational financial decisions.

Fear, Greed, and Loss Aversion: Emotional Triggers in Financial Decisions

Fear, greed, and loss aversion are powerful emotional triggers that significantly influence financial decisions. Fear often leads to risk aversion, causing investors to sell low during market downturns. Greed, on the other hand, can drive individuals to take excessive risks in pursuit of higher returns, oftentimes resulting in poor investment choices. Loss aversion amplifies the pain of losses, making people hold onto failing investments too long in hopes of recovering. These emotions create a volatile mix that can derail even the most well-thought-out financial strategies, emphasizing the need for self-awareness and disciplined decision-making.

The Role of Habits in Shaping Financial Outcomes

Habits play a crucial role in determining financial success. Consistent saving, disciplined spending, and regular investing are examples of positive habits that compound over time. Conversely, impulsive purchases and procrastination can lead to financial instability. Automating savings and investments fosters consistency, reducing the impact of emotional decision-making. Small, sustainable changes in behavior often yield significant long-term results, highlighting the importance of cultivating good financial habits early on. By focusing on routine actions rather than grand gestures, individuals can build a stable financial foundation and achieve their goals more effectively.

The Psychology of Investing

Investing decisions are influenced by emotions, cognitive biases, and personal beliefs, often leading to irrational choices that contradict logical financial strategies and market realities.

Why Investors Sell Low and Buy High: The Psychology of Market Timing

Investors often sell low and buy high due to emotional responses, such as fear during downturns and greed during upswings, leading to poor market timing decisions. This behavior stems from cognitive biases like loss aversion and confirmation bias, which cloud rational judgment. Additionally, the agony of potential losses often outweighs the logic of expected future returns, causing impulsive actions. Understanding these psychological triggers is crucial for developing disciplined investment strategies that align with long-term financial goals rather than short-term emotional reactions. This phenomenon highlights the importance of emotional resilience in investing.

The Impact of Confirmation Bias on Investment Choices

Confirmation bias significantly influences investment decisions by leading individuals to favor information that aligns with their preexisting beliefs. This cognitive bias causes investors to overlook contradictory data, reinforcing misguided strategies. For instance, they might ignore market downturns if they are optimistic about a stock, or vice versa. This selective perception distorts rational analysis, leading to suboptimal choices. By seeking only validating information, investors often miss critical signals, resulting in poor portfolio performance. Recognizing and addressing confirmation bias is essential for making objective, data-driven decisions and achieving long-term financial success. It underscores the need for diversification and open-mindedness in investing.

Wealth and Money Mindset

Wealth and money mindset shape how individuals perceive financial success, emphasizing long-term stability over short-term gains. It’s about cultivating habits that foster financial resilience and psychological freedom.

The Difference Between Being Rich and Being Wealthy

Being rich often refers to short-term financial gains, while being wealthy involves long-term financial stability and independence. Wealth encompasses assets that generate income, ensuring sustainability beyond immediate riches. It reflects a mindset focused on saving, investing, and compounding over time. True wealth provides psychological security, allowing individuals to pursue their passions without financial stress. This distinction highlights that wealth is not just about accumulating money but creating a lasting legacy and freedom. Understanding this difference is crucial for making informed financial decisions that prioritize long-term prosperity over fleeting gains.

Money as a Tool for Psychological Security and Freedom

Money serves as a powerful tool for achieving psychological security and freedom. Financial stability reduces stress, providing peace of mind and the confidence to pursue life goals. Wealth offers independence, enabling individuals to make choices aligned with their values. It allows people to take risks, invest in opportunities, and create lasting legacies. Beyond material comfort, money fosters a sense of control and autonomy, which are essential for emotional well-being. By managing finances effectively, individuals can transform money into a catalyst for personal growth and fulfillment, ensuring long-term happiness and security.

Societal and Cultural Influences on Money Behavior

Cultural norms and societal expectations profoundly shape spending and saving habits, influencing financial decisions and attitudes toward wealth accumulation and status symbols.

How Cultural Norms Shape Spending and Saving Habits

Cultural norms significantly influence financial behavior, as societal values dictate attitudes toward money. For instance, some cultures emphasize saving and frugality, while others prioritize spending and conspicuous consumption. These norms often stem from historical contexts, religious beliefs, or community expectations. In societies where status symbols are valued, individuals may prioritize acquiring luxury goods to gain social approval. Conversely, cultures that stress financial prudence often encourage long-term savings and investment. These deeply ingrained norms shape individual behaviors, making financial decisions less about logic and more about aligning with societal expectations and avoiding judgment.

The Role of Status Symbols in Financial Decision-Making

Status symbols influence financial decisions, driving spending on luxury items to display wealth and social standing. These symbols, like designer goods or expensive cars, signal success and are often purchased to gain social approval and avoid judgment. The desire to belong and fear of inferiority lead to irrational buying decisions. Rooted in psychology rather than practical needs, such behavior shows how emotions often override logical financial planning, affecting long-term security and personal freedom.

Understanding the psychology of money is crucial for achieving financial freedom and happiness, as it reveals how emotions and beliefs shape our decisions.

The Long-Term Importance of Understanding the Psychology of Money

Understanding the psychology of money is essential for long-term financial success. It helps individuals recognize emotional triggers, avoid costly mistakes, and build healthier relationships with wealth; By grasping how cognitive biases and personal experiences influence decisions, people can make more rational choices. This knowledge fosters financial freedom, reduces stress, and aligns money management with personal values. Over time, it cultivates a mindset that views money as a tool for security and happiness, rather than a source of anxiety or greed. Ultimately, it empowers individuals to navigate life’s uncertainties with confidence and clarity.