Form 990 Schedule J Instructions: A Comprehensive Plan

Form 990 Schedule J details executive compensation, requiring organizations to report payments to key employees and independent contractors exceeding specified thresholds․

This schedule ensures transparency regarding leadership remuneration, aiding in public scrutiny and compliance with IRS regulations for tax-exempt entities․

Understanding these instructions is crucial for accurate filing and avoiding potential penalties, especially concerning related organization compensation․

Form 990 Schedule J serves as a critical component of the annual information return filed by organizations exempt from income tax, providing detailed insights into the compensation of key personnel․ It’s designed to ensure transparency and accountability in the non-profit sector, allowing the Internal Revenue Service (IRS) and the public to assess the reasonableness of executive compensation packages․

This schedule is not merely a reporting formality; it’s a vital tool for maintaining public trust and demonstrating responsible stewardship of charitable assets․ All filing organizations, regardless of their 501(c) designation, are required to complete Schedule J if they meet certain compensation thresholds․ The IRS instructions emphasize the importance of accurately identifying and reporting compensation paid to the organization’s five highest compensated employees, as well as independent contractors receiving over $100,000 for services․

Schedule J delves into the specifics of compensation, breaking it down into various components like base salary, bonuses, deferred compensation, and non-deductible amounts․ It also requires reporting compensation received from related organizations, offering a comprehensive view of an individual’s total remuneration․ The 2025 Form 990, used for the 2025 calendar year, necessitates careful attention to these details to ensure compliance and avoid potential issues during an IRS review․

II․ Purpose of Schedule J

The primary purpose of Schedule J is to provide a clear and detailed accounting of compensation paid to an organization’s key employees and highest-compensated independent contractors․ This reporting requirement directly supports the IRS’s oversight of tax-exempt organizations, ensuring that compensation practices align with the organization’s exempt purpose and are reasonable in relation to services provided․

Schedule J aims to deter excessive compensation and potential conflicts of interest within non-profit organizations․ By publicly disclosing this information, it promotes accountability to donors, beneficiaries, and the broader community․ The schedule facilitates scrutiny of executive pay, helping to maintain public trust in the charitable sector․

Furthermore, Schedule J assists the IRS in identifying potential instances of improper private benefit, where an organization’s resources are used to enrich individuals rather than further its charitable mission․ It’s crucial for organizations to understand that reporting extends beyond direct payments, encompassing various forms of compensation, including deferred amounts and benefits from related entities․ Accurate completion of Schedule J is therefore essential for demonstrating responsible financial management and maintaining tax-exempt status․

III․ Who Must File Schedule J?

Generally, all organizations required to file Form 990, “Return of Organization Exempt From Income Tax,” must also file Schedule J․ This includes most 501(c)(3) organizations, as well as other types of tax-exempt entities, regardless of their specific exemption category․ The filing obligation isn’t limited to public charities; private foundations are also required to submit Schedule J․

Specifically, organizations must file if they paid more than $100,000 in reportable compensation to any officer, director, trustee, key employee, or one of the five highest compensated employees․ This threshold applies to compensation from both the organization itself and any related organizations․

Additionally, Schedule J must be filed if the organization paid more than $100,000 to any independent contractor for services rendered․ It’s important to note that this applies to the total compensation paid, not just the amount exceeding $100,000․ Failing to file Schedule J when required can result in penalties and jeopardize the organization’s tax-exempt status, so diligent assessment of compensation levels is vital․

IV․ Reporting Thresholds for Compensation

Schedule J triggers reporting requirements when an organization pays reportable compensation exceeding specific thresholds to key personnel․ The primary threshold is $100,000; Any officer, director, trustee, key employee, or one of the five highest compensated employees receiving over $100,000 in compensation from the organization or related organizations must be reported․

This $100,000 threshold applies to the total compensation, encompassing base salary, bonuses, and other forms of remuneration․ It’s crucial to include compensation from all related tax-exempt organizations, not just the filing entity․ Furthermore, independent contractors receiving over $100,000 for services also necessitate reporting on Schedule J․

Special filing requirements apply to former key employees who were highly compensated in one of the five prior years․ Organizations must report compensation paid to these individuals even if their current compensation falls below the $100,000 threshold, ensuring continued transparency regarding past leadership remuneration․

V․ Key Employees and Reporting Requirements

Key employees, as defined by the IRS, necessitate detailed reporting on Schedule J․ These individuals are crucial to the organization’s operations and typically hold significant authority․ Reporting requirements extend to all officers, directors, trustees, and the five highest compensated employees receiving over $100,000 in reportable compensation․

Organizations must meticulously document each key employee’s compensation details in Part II of Schedule J, broken down into specific columns․ This includes base compensation (Column B(I)), bonuses and other compensation (Column B(II)), deferred compensation (Column B(III)), nondeductible compensation (Column C), and compensation from related organizations (Column D)․

Accurate reporting demands careful consideration of all forms of remuneration, including benefits, allowances, and expense reimbursements․ Utilizing Form W-2 (Box 1 or 5, whichever is greater) or Form 1099-MISC/NEC (Box 6 or 1, respectively) as a source for base compensation is essential for compliance․

VI․ Former Key Employees ⎯ Special Filing Rules

Schedule J incorporates specific rules for former key employees, demanding continued reporting even after their departure․ If an individual was an officer, director, trustee, key employee, or among the five highest compensated in any of the five prior reporting years, their compensation must still be reported․

This requirement ensures transparency regarding past leadership remuneration and prevents organizations from avoiding scrutiny by simply terminating a highly compensated individual․ The reporting obligation extends to compensation paid during the current reporting year, even if it relates to prior service․

Organizations must clearly identify former key employees on Schedule J and provide the same detailed compensation breakdown as current employees, utilizing Columns B(I) through D․ This includes accurately reflecting any deferred compensation payments or benefits accrued during their tenure․ Failing to report former key employee compensation can result in penalties and necessitate amended filings․

VII․ Understanding the Five Highest Compensated Employees

Schedule J mandates reporting for an organization’s five highest compensated employees, regardless of their official title․ This includes individuals receiving over $100,000 in reportable compensation from the organization and related organizations combined․ Compensation encompasses salary, bonuses, and other forms of remuneration․

Identifying these individuals requires careful analysis of W-2s, 1099s, and other compensation records․ The focus isn’t solely on base salary; all reportable compensation must be considered when determining the top five․ Organizations must list these employees by name and provide a detailed breakdown of their compensation in Part II of Schedule J․

Accurate reporting is crucial, as the IRS scrutinizes this section closely․ Organizations should establish clear procedures for identifying and tracking compensation paid to these key individuals․ Remember, the $100,000 threshold applies to the total compensation from all sources related to the organization․

VIII․ Independent Contractors Reporting ($100,000+ threshold)

Schedule J also requires reporting payments to independent contractors exceeding $100,000 during the organization’s tax year․ Similar to employees, this reporting aims to ensure transparency in financial dealings and prevent potential conflicts of interest․ This applies to all organizations, not just those with 501(c)(3) status․

Identifying these contractors necessitates reviewing 1099-MISC and 1099-NEC forms․ The $100,000 threshold is based on the total amount paid to each contractor for services rendered․ Organizations must list the contractor’s name, address, and the nature of the services provided, alongside the total compensation paid․

Proper categorization of individuals as either employees or independent contractors is vital․ Misclassification can lead to significant penalties․ Organizations should carefully assess the relationship with each service provider to ensure accurate reporting on Schedule J․ Thorough documentation supporting the classification is highly recommended․

IX․ Schedule J, Part II: Compensation Details ⎯ Overview

Part II of Schedule J is the core of executive compensation reporting, demanding a detailed breakdown of each individual’s remuneration․ This section is structured with several key columns, each capturing a specific component of total compensation․ Understanding these columns is crucial for accurate completion․

The layout features five primary sections, labeled Columns B(I) through B(III), Column C, and Column D․ Each column contributes to the overall reported compensation figure․ The IRS instructions provide precise definitions for each, ensuring consistent application across all organizations․

Organizations must meticulously populate each column with the appropriate amounts for each listed individual․ This includes base compensation, bonuses, deferred compensation, nondeductible compensation, and reportable compensation from related organizations․ Accuracy is paramount, as these figures are subject to IRS review․ Supplemental narrative explanations can be added using Schedule O․

X․ Column B(I): Base Compensation Definition

Column B(I) on Schedule J specifically requests a reporting of “Base Compensation․” The IRS defines this as the individual’s fundamental earnings, directly tied to their employment agreement․ This figure is derived from specific boxes on standard tax forms․

For employees receiving a W-2, base compensation is the amount reported in either box 1 (wages, tips, other compensation) or box 5 (medical and health savings plans), whichever is greater․ This ensures the primary earnings component is accurately reflected․

If the individual is an independent contractor receiving a 1099-MISC or 1099-NEC, base compensation is sourced from box 6 of Form 1099-MISC or box 1 of Form 1099-NEC․ This standardized approach ensures consistency in reporting across different compensation structures․ Organizations must adhere to these IRS definitions when completing Column B(I) to avoid discrepancies and potential issues during review․

XI․ Column B(II): Bonus & Other Compensation

Column B(II) of Schedule J captures all compensation beyond base salary, encompassing bonuses, commissions, and other supplemental payments․ This section requires a comprehensive accounting of all non-salary earnings provided to key employees and highly compensated individuals․

Examples of items included in Column B(II) are performance-based bonuses, profit-sharing distributions, and any other discretionary payments made to the individual․ It also includes non-cash benefits that have a taxable value, such as personal use of company property or certain fringe benefits․

Organizations must carefully distinguish between items reported in Column B(I) (base compensation) and Column B(II)․ Accurate categorization is vital for compliance․ This column provides a clearer picture of the total remuneration package, offering insight into performance incentives and additional benefits received by key personnel․ Thorough documentation supporting these figures is highly recommended․

XII․ Column B(III): Deferred Compensation

Column B(III) on Schedule J specifically addresses deferred compensation arrangements․ This includes amounts earned by key employees but not yet paid, representing a future financial obligation for the organization․ Deferred compensation plans allow individuals to postpone receiving income until a later date, often for tax planning purposes․

Examples include contributions to nonqualified deferred compensation plans (NQDC), supplemental executive retirement plans (SERPs), and similar arrangements where income is earned in one year but paid in a subsequent year․ It’s crucial to report the accrued amount of deferred compensation for the reporting period, not the actual payment date․

Organizations must adhere to strict accounting rules when reporting deferred compensation․ This column ensures transparency regarding long-term financial commitments to key personnel․ Proper reporting in Column B(III) is essential for accurate financial statements and compliance with IRS regulations regarding executive compensation․

XIII․ Column C: Nondeductible Compensation

Column C of Schedule J focuses on reporting nondeductible compensation paid to key employees․ This refers to amounts paid that the organization cannot deduct as a business expense under IRS regulations․ Common examples include certain excess parachute payments or compensation deemed unreasonable by the IRS․

Organizations must carefully identify and report any compensation lacking deductibility, as it impacts their tax liability․ This column ensures the IRS has a clear understanding of the organization’s compensation practices and associated tax implications․ Accurate reporting is vital for maintaining tax-exempt status and avoiding penalties․

The amount reported in Column C should correspond directly to the nondeductible portion of the compensation paid to the individual․ It’s essential to consult IRS guidelines and potentially seek professional tax advice to determine which compensation qualifies as nondeductible․ Proper categorization and reporting in Column C demonstrate financial accountability and compliance․

XIV․ Column D: Reportable Compensation from Related Organizations

Column D on Schedule J requires organizations to disclose compensation received by key employees from related tax-exempt organizations․ This encompasses payments from entities with which the filing organization has a close relationship, such as affiliated organizations or commonly controlled groups․

Reporting in Column D is crucial for transparency and preventing potential conflicts of interest․ It allows the IRS to assess the overall compensation picture for key employees across multiple organizations, ensuring fair and reasonable practices․ This includes compensation from organizations that share officers, directors, or significant financial ties․

Organizations must diligently identify all reportable compensation from related entities and accurately reflect those amounts in Column D․ Failure to do so can result in penalties and scrutiny from the IRS․ This column highlights the interconnectedness of compensation within the non-profit sector and promotes accountability․

XV․ Using Schedule O for Supplemental Narrative

Schedule O (Form 990) serves as the crucial space for providing supplemental explanations and narratives related to responses on both the core Form 990 and its schedules, including Schedule J․ When specific questions require further clarification or context, Schedule O is the designated location to elaborate․

For Schedule J, this might involve detailing unique compensation arrangements, explaining the rationale behind significant bonus payments, or clarifying the nature of deferred compensation․ Organizations should utilize Schedule O to provide a comprehensive understanding of the reported compensation data, addressing any potential ambiguities․

The IRS instructions explicitly state that supplemental narratives for schedule questions should be included within the narrative part of each schedule itself, reinforcing Schedule O’s importance․ A well-crafted narrative on Schedule O demonstrates transparency and a commitment to accurate reporting, potentially mitigating IRS inquiries․

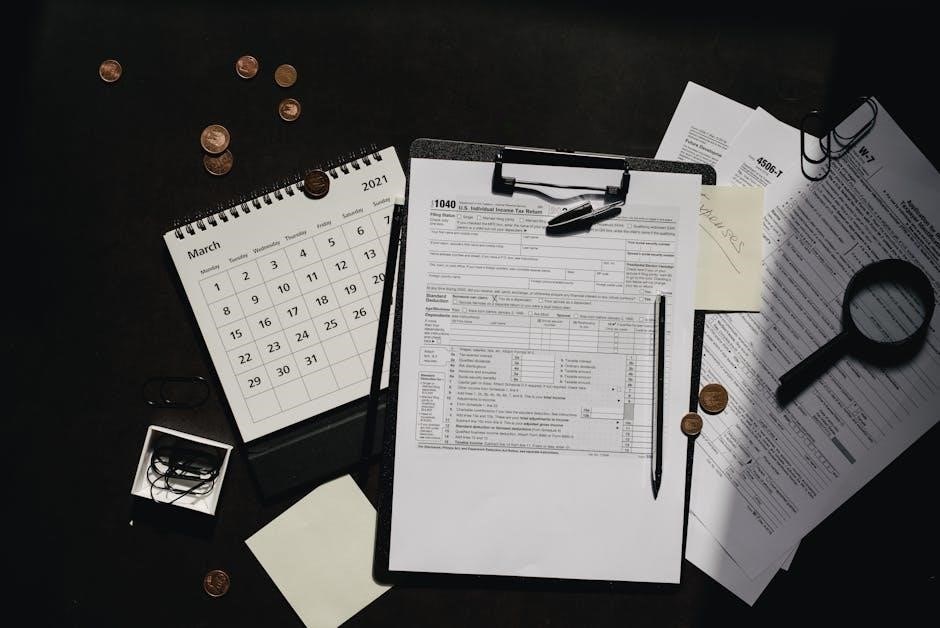

XVI․ Accounting Periods and Form 990 Year (2025 Form for 2025 Calendar Year)

Understanding the applicable accounting period is fundamental to accurate Form 990 and Schedule J filing․ Most organizations operate on a calendar-year basis, beginning January 1st and ending December 31st․ However, some may utilize a fiscal year․ Regardless, the Form 990 reports on activities during that specific accounting period․

Crucially, the 2025 Form 990 is used to report information for the 2025 calendar year․ This means all compensation reported on Schedule J – base salary, bonuses, deferred compensation, and other benefits – must reflect amounts paid or accrued during January 1, 2025, through December 31, 2025․

Organizations must adhere to these timelines to avoid penalties and ensure compliance․ Proper record-keeping throughout the year is essential for accurately completing Schedule J and the associated Form 990․ Failing to use the correct form for the correct year will result in rejection․